If you want to regain control of your finances and win against debt collectors and debt disputes, look no further than SoloSuit.

We’ve been following the company since it first launched in 2018 and have seen firsthand how it’s evolved into a powerful tool for those trying to beat debt collectors at their own game.

Not only does it provide an easy-to-use suite of online tools that make filing a debt lawsuit simpler than ever before – saving you time, stress, and money on legal fees – but with the platform as your one-stop shop for managing your debts, you also get access to expert advice from financial counselors who can help guide you through the process.

In this Solosuit review, we’ll explore why the platform is worth considering when fighting against aggressive creditors or collections agencies.

Table of Contents

What is Solosuit?

Solosuit is a groundbreaking legal platform designed to make responding to debt collection lawsuits more accessible and less daunting for individuals.

The innovation behind the platform stems from the common challenge faced by consumers who are often ill-equipped to navigate complex legal documentation and proceedings.

By offering step-by-step guidance on how to draft the necessary documents, the platform provides a user-friendly solution that empowers consumers to defend themselves against debt collectors.

This all-important digital tool not only simplifies the legal process but also levels the playing field, enabling people to assert their rights and, ultimately, regain control over their financial well-being.

Who Created Solosuit?

Solosuit is an innovative and user-friendly platform designed to assist individuals facing debt-collection lawsuits.

The mastermind behind this empowering tool is George Simons, a co-founder, who envisioned a way to level the playing field for those in need.

As an attorney and entrepreneur, George recognized the glaring gaps in legal representation and assistance for people with limited resources.

The platform became an intelligent technological solution that simplifies the complex process of responding to lawsuits and enables individuals to defend themselves proactively.

George Simons’ dedication to creating a more accessible and equitable legal landscape through modern technology like Solosuit is an inspiring example of harnessing innovation for social good.

Top Benefits of Solosuit

1. Affordable Legal Protection: Solosuit provides easy-to-use online tools to respond to debt collection lawsuits without a lawyer. This makes responding to lawsuits easier, faster, and more affordable.

2. Experienced Guidance: The platform also offers access to experienced financial counselors who can help guide you through the process and provide valuable advice.

3. Comprehensive Approach: Solosuit takes a comprehensive approach to a debt lawsuit by helping consumers manage their debts, providing legal resources, and giving them the tools to beat debt collectors in court.

Best Features of Solosuit

Discover the incredible services of Solosuit, a revolutionary product designed to help you combat debt collection lawsuits quickly and confidently.

With this platform, you no longer have to stress and worry about navigating the legal system alone.

Its user-friendly platform enables you to gather all the necessary information, generate a strong case, and submit your defense with just a few clicks.

Moreover, Solosuit’s AI capabilities and expert advice from attorneys ensure that your case will be well-prepared and persuasive, maximizing your chances of success against daunting creditors.

Here are some of the best features of this platform:

Debt Answer

This feature of Solosuit is beneficial when responding to debt.

By helping people respond to their rights, the company allows them to resolve quickly.

This makes the platform stand out from other companies because they take the initiative to ensure clients get the best possible outcome by letting them make a professional complaint.

It also grants companies more time and less hassle in efficiently responding to and resolving debts.

SoloSettle

SoloSettle is an automated system designed to help users quickly settle their debt.

This feature works by taking the necessary information and generating a settlement offer that can be sent directly to the creditor or debt collector.

The automated system also helps clients decide if they have enough funds to make payments, helping them settle debts without hassle.

This automated system makes the debt settlement process easier and more efficient, allowing users to quickly resolve their debts without relying on expensive lawyers or legal assistance.

Debt Validation Letter

The Debt Validation Letter feature of Solosuit makes it easier for individuals to dispute inaccuracies and fraudulent claims from creditors and debt collectors.

This feature enables users to generate a letter that can be sent directly to a creditor or debt collector, asking them to verify the accuracy of their claim before taking any legal action.

This feature helps users protect their legal rights and gives them peace of mind that they won’t be taken advantage of.

Additionally, this feature allows users to save money by avoiding the cost of hiring a lawyer or getting outside legal help.

Motion to Compel Arbitration

This feature helps users stop harassing debt collection calls and letters by filing a Motion to Compel Arbitration.

This legal document requests that the court enforces an agreement between the creditor and debtor, thus stopping any further communication or legal action until both parties agree to arbitration.

This feature ensures that individuals are protected from abuse while trying to settle their debt.

Solosuit Pricing: How much does it Cost?

Discover the incredible value of Solosuit with its affordable pricing designed to accommodate a range of budgets.

It is an efficient and user-friendly platform that can help you tackle debt lawsuits without breaking the bank.

Too often, individuals facing a debt collection lawsuit find themselves stranded, unsure of where to turn, and unable to hire a legal professional due to daunting costs.

Solosuit comes to the rescue, offering an affordable solution that fits perfectly within your financial constraints.

Through this platform, you get automated, step-by-step guidance in crafting a solid response to your debt lawsuit, ensuring you have the best possible chance against creditors but without a heavy price tag.

The pricing plans are not stated on the homepage. Contact their admin to learn more about its pricing.

Solosuit’s Pros and Cons

It is essential to investigate the pros and cons of Solosuit. This innovative platform simplifies the process of responding to debt lawsuits to make an informed decision about whether it’s the right solution for you.

By examining the advantages and drawbacks of this service, we can evaluate its effectiveness in streamlining the legal process and protecting consumer rights.

Many people facing debt collection lawsuits are overwhelmed by the legal system’s complexity, and understanding the nuances of this platform can help alleviate some of that stress.

Furthermore, by delving into its merits and shortcomings, we may discover ways to improve or augment the platform, ensuring that it continues to be a valuable resource for employees and investors.

Pros

Cons

Solosuit’s Alternatives

Users may want to find other alternatives for Solosuit, and luckily, the market of competitors boasts multiple innovative solutions.

Paying court document filing fees has never been easier with the help of reliable competitors that offer the same convenience as Solosuit but allow users to customize their plans according to their needs.

These platforms will provide you with access to experts in the legal field, providing guidance on what steps one should take while filing documents. They also usually offer lower prices and more flexibility than some traditional methods.

Here are some of the best alternatives for Solosuit to explore in 2023:

- LegalKart

- RivalSoft

- Element

- Match2One

- Dragonboat

- Legal hero

- ZenBusiness

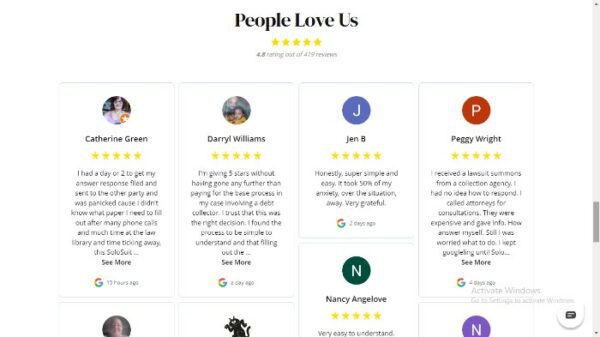

Solosuit’s Case Studies: Results Achieved with Platform

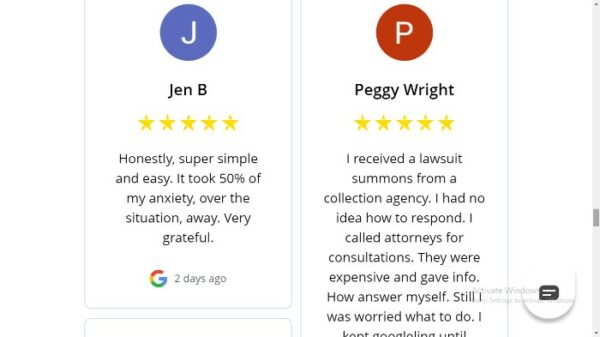

Solosuit has had numerous success stories over the years, with individuals and businesses benefitting from its innovative platform.

The platform has enabled customers to reduce their debt by consolidating it into one manageable payment while saving time and legal stress.

By learning from the stories of other users, potential customers can better understand how Solosuit promotes success in tackling debt lawsuits.

For instance, a customer in New York was able to get the debt validation letter accepted by its creditor and reduce their initial payment plan from $500/month to only $200/month.

Another customer, a small business owner in California, successfully negotiated a settlement agreement with creditors using this platform.

The business owner reported that they could save 50% on their debt payment compared to what they would have had to pay if the case went to court.

These are just a few examples of how the platform can help debtors manage and navigate the legal system more efficiently.

By providing users with efficient tools, easy-to-follow guidance, and assistance from dedicated professionals, this platform can help people tackle their debt collection lawsuits more effectively.

My Experience using Solosuit to Settle a Debt Collection Lawsuit

I used Solosuit when a creditor sued me for an unpaid debt. The platform provided me with all the necessary information regarding my case and how to respond to it.

It also gave me step-by-step instructions on how to file the necessary documents, and I managed the entire process without any legal assistance or representation.

The best part was that I could navigate the platform and its services anytime, so I didn’t have to take time out of my busy schedule to focus on my debt-related issues.

The online document generator also made it easy to draft letters and other documents quickly and efficiently.

In the end, I was able to negotiate a settlement with the creditor and was able to reduce my debt payment significantly.

The experience was stress-free, and I am glad I chose Solosuit for help with my case.

Conclusion

Overall, Solosuit is the perfect platform for individuals to manage debt collection lawsuits quickly and efficiently. Its automated process makes it easy to stay organized as deadlines approach.

Plus, with their advanced data collection tools and up-to-date knowledge base, you can rest assured that you are armed with the latest tools and industry know-how – providing more time for peace of mind during this stressful legal process.

When debt collection becomes a reality, take control with Solosuit and sail through settlement without a hitch.

So don’t wait for someone else to get the upper hand; take care of your legal obligations with confidence and convenience today!