Have you been looking for an easy and convenient way to pay for unexpected expenses? If so, Sunbit might be the perfect solution.

This app lets users conveniently choose how they’d like to purchase items—whether through short-term installment payments or longer in-store financing options.

Through this review of Sunbit’s services, we’ll explore why it could be one of the best ways to pay over time and how it can help save you money while giving you more flexibility with your finances.

Table of Contents

What’s Sunbit?

Sunbit is a financial technology company revolutionizing how people pay for products and services. Their installment payment platform offers customers the flexibility to pay for big-ticket items over a series of manageable payments.

Their technology-driven approach allows for an easy and efficient application process with instant approvals, no hidden or late fees or costs, and no impact on credit scores.

The platform works with businesses of all sizes to provide an affordable and accessible payment option that benefits both the merchant and the customer.

So, whether you’re looking to buy a new laptop or get your car serviced, this platform is the solution that puts financial freedom within reach.

Who Created Sunbit?

Tal Riesenfeld, also the CEO, co-founded Sunbit in 2016 to provide an easy and secure way for customers to finance their purchases. With more than 10 years of experience in digital payments, Riesenfeld’s expertise has significantly influenced Sunbit’s success.

The company has since become one of the leading providers of installment financing, helping thousands of consumers access the products and services they need.

It is also backed by prominent venture capital firms such as Greylock Partners and Battery Ventures, demonstrating the company’s commitment to providing innovative solutions for customers.

Top Benefits of Using Sunbit

1. Quick and Easy Application Process: The platform makes it easy to apply for financing with a fast, secure online application process that takes less than 10 minutes to complete.

The entire process is entirely digital and requires no credit check, making it ideal for those who don’t want to go through a lengthy loan process or have bad credit.

2. Flexible Payment Options: It lets you choose the payment plan that works best for you. You can decide to pay over 6, 12, or 24 months with no hidden costs or fees.

3. Transparent Terms: The platform is committed to transparency and disclosure of all terms and conditions upfront so that you know exactly what you’re getting into.

The platform offers a variety of payment plans with no hidden fees or costs, making it easier to budget your payments and stay on track.

Best Features of Sunbit

Sunbit stands out among its competitors regarding funding support. They offer fair and flexible payment plans while still understanding the financial constraints of organizations big and small.

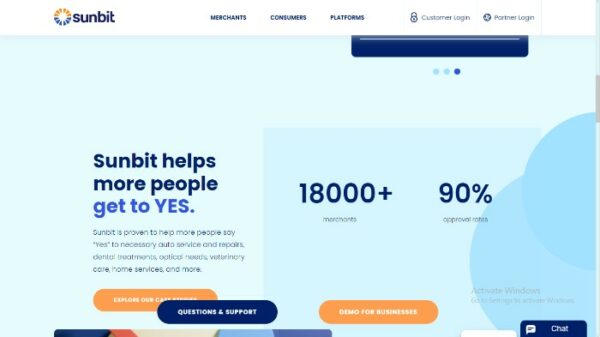

Fast Approval Rates

With Sunbit’s advanced technology, you can get financing approved in seconds. No need to worry about long waiting periods or complicated application forms.

Sunbit’s financing options are tailored to your specific needs, making it easier for you to make the right financial decisions.

So, whether you need a quick fix for unexpected expenses or want to make a more significant purchase, Sunbit’s fast approval rates and flexible financing options can help.

Mobile Access

Sunbit’s mobile platform makes it easy to access and manage your financing mobile phones, including Android phones.

Whether you’re an individual or a business, you can monitor payments, track spending, and make updates using Sunbit’s intuitive mobile app.

Plus, with specialized features such as real-time notifications, you can stay up-to-date on your account activity and ensure you’re always in control of your finances.

Secure Payments

Sunbit offers secure and reliable payment solutions, so you don’t have to worry about the safety of your funds. All transactions are encrypted, secure, and compliant with industry standards.

The platform also provides fraud protection to guard against unauthorized payments. So you can focus on what matters most – your business and customers.

Sunbit Pricing: How Much Does it Cost?

The platform does not charge account fees; instead, they charge based on the number of loans and the duration.

For example, Loan Amount: $50 – $20,000

Loan Term: 3 to 72 months

Annual Percentage Rate: 0-35.99% APR

Payment is due at checkout.

However, Sunbit’s terms indicate that the most extensive loan amounts and most extended terms are unavailable to all merchants.

Only the most creditworthy applicants qualify for the lowest rates, most extensive loan amounts, and most extended terms. 0% APR plans are not available at all merchants.

Sunbit’s Pros and Cons

As consumers, it’s essential that we do our research before making any big purchase, including understanding the pros and cons of using this platform.

While the platform offers a quick and easy way to finance smaller purchases, there are a few factors to consider.

Whether the platform is right depends on your financial situation and needs. You can make an informed decision that works for you by weighing the pros and cons.

Pros

Cons

Sunbit’s Alternatives

Sunbit is an excellent alternative to traditional financing options for those looking to purchase but doesn’t have the funds readily available.

It’s good to know there are other options out there as well. It’s essential to research and compare your options before deciding on the best financing option for your needs.

However, we have compiled a list of some of the best alternatives for this platform:

- GoCardless

- PayPal

- Sezzle

- PayPal Credit

- Affirm

- Klarna

- Splitit

- Afterpay

- care credit vs sunbit

These options can provide convenient and flexible financing, depending on your needs. Each alternative provider has different terms and conditions you should consider before deciding.

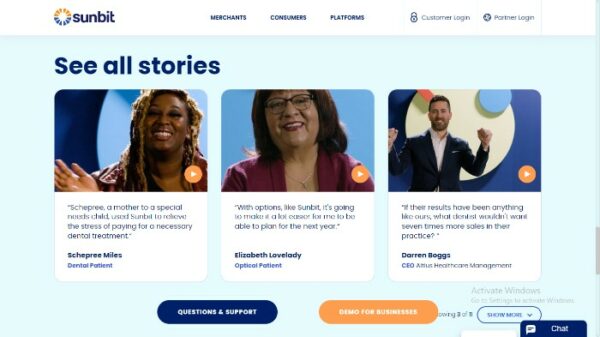

Sunbit’s Case Studies: Results Achieved with the Sunbit Technology

Sunbit’s technology has helped many businesses and individuals reach their financial goals.

For example, the CEO of Altius Healthcare Management, Darren Boggs, used the Sunbit platform to finance construction projects for their business.

With Sunbit’s financing options, Altius Healthcare Management was able to increase its cash flow and reduce debt.

In another case study, the CEO of Car & Truck Accessories Inc., John Carter, used Sunbit’s technology to purchase a fleet of vehicles. The purchase allowed the business to increase its revenue without increasing debt.

These are just two examples of how this y can help businesses and individuals achieve their financial goals.

Sunbit’s technology has helped many businesses secure funding for growth and expansion and/or serve as a source of emergency funds when needed.

My Experience using Sunbit

I recently used this innovative platform to finance a purchase that I otherwise would not have been able to make. The approval process was quick and straightforward, and I could customize my payment plan depending on my needs.

I found the overall experience of using Sunbit’s technology convenient, secure, and fast. I recommend their services to anyone looking for a quick and easy financing.

Does Sunbit do a Hard Credit Check?

The platform does not do a hard credit check. The platform utilizes technology to make an instant decision based on the applicant’s overall financial profile.

This means applicants can receive an approval within minutes without affecting their credit scores. The Sunbit team will review your information and assess your ability to repay the loan before approving or declining your application.

Conclusion

With sunbit login, you can make informed payment decisions no matter your credit score. Through a combination of advanced technology and experienced team members, the platform helps you reach your financial goals based on the tools that fit your budget.

By utilizing the latest innovations in financial technology, the platform provides a secure and streamlined platform that gives customers the confidence to pay bills online efficiently and responsibly.

Along with helping customers access affordable financing products, the company also serves as a powerful ally for companies seeking to structure their payment processing options through an all-in-one platform strategically.

In short, Sunbit is revolutionizing how we pay for goods and services – something that has never been done before!

As such, it makes sense to do what thousands of people across the country have already done: try Sunbit today and experience its firsthand benefits.