Best Overall

Fondo

Your Tax Credits & Bookkeeping on Autopilot.

Table of Contents

Overview – Your Tax Credits & Bookkeeping on Autopilot

Fondo is your ultimate sidekick, seamlessly blending bookkeeping and corporate taxes into a single, powerful platform designed specifically for startups.

It furnishes founders with the tools required to streamline their accounts effortlessly, letting them focus on what they do best – innovating and growing their business.

Key Takeaways

Fondo is an AI-powered platform that streamlines taxes and tax credits for startups.

The platform is an easy accounting solution for busy founders to get bookkeeping done, get taxes filed, and get cash back from the

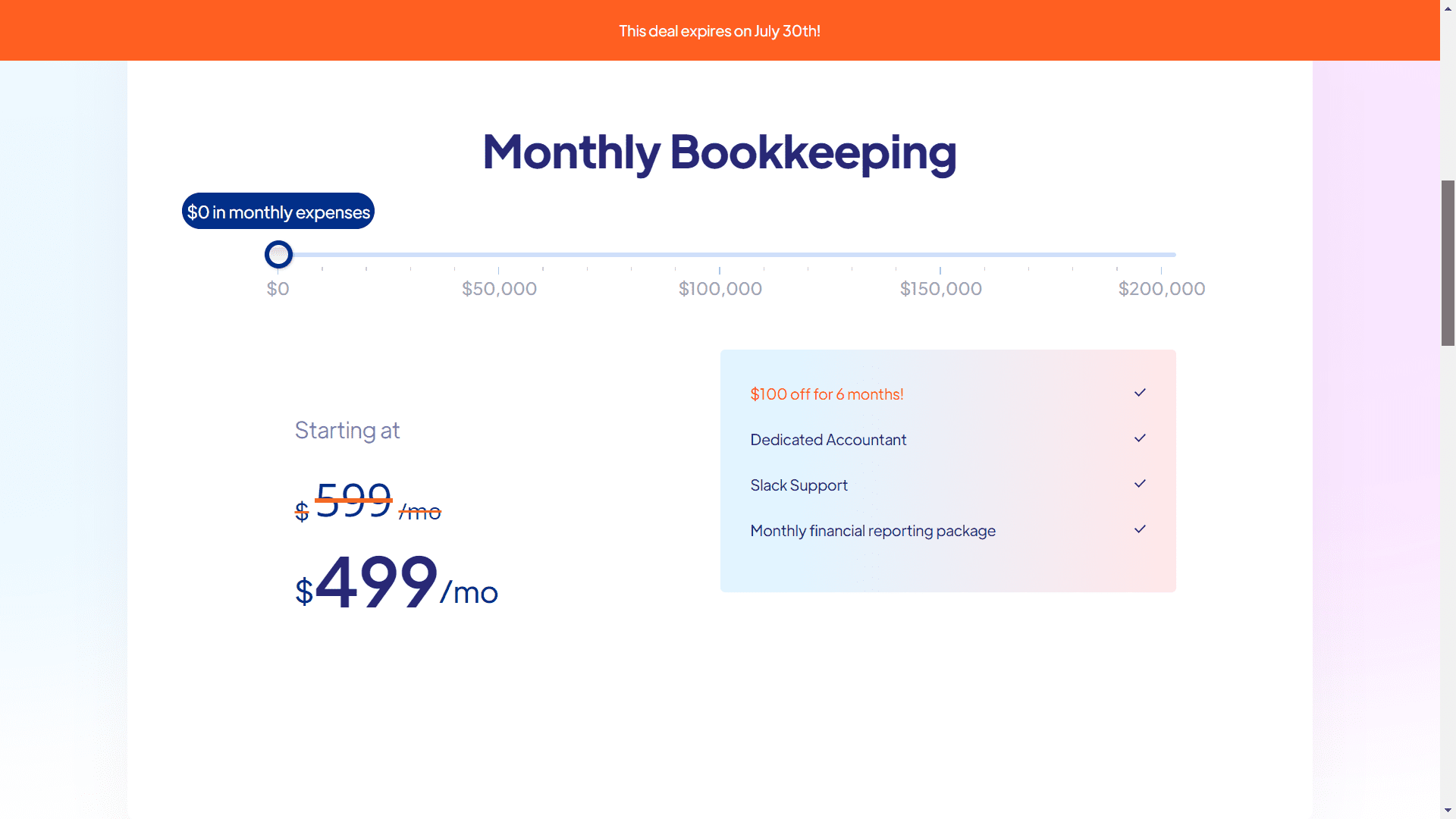

IRS.Fondo offers different pricing plans for users, and the lowest price starts at $499/month.

The platform partners with top financial institutions to ensure the safety and security of users’ sensitive financial data.

How Fondo Works

Get Your Taxes Filed and Cash Credits – With all your financial information streamlined, Fondo will file your taxes, ensuring you receive any due cash credits from the IRS quickly, boosting your company’s cash flow and financial health.

Describe Your Startup – Quickly input details about your company, allowing Fondo to tailor the service to your startup’s unique needs.

Connect Your Accounts – Connect your bank and credit accounts to enable real-time bookkeeping and tax assessments.

Meet Your Dedicated Team – Fondo assigns you a team of experts, including accountants and tax advisors, who understand your business goals and investor expectations.

Get Your Financial Reports: Receive comprehensive, easy-to-understand financial reports informing you and your investors.

Get Your Taxes Filed and Cash Credits: Fondo file your taxes, maximize your returns, and secure cash credits from the IRS, all with minimal effort from your side.

Key Features & Benefits

Delaware Franchise Tax for Startups

Simplifies the complex process of calculating and filing Delaware Franchise Taxes, ensuring compliance and accuracy.

Offers strategic advice on minimizing franchise tax obligations and maximizing financial efficiency.

Provides clear, step-by-step guidance through the filing process, making it easier for startups to manage their obligations.

AI-powered Tax Credits

Maximizes eligible tax credits for startups by leveraging cutting-edge AI technology.

Identifies and applies for federal, state, and local tax credits based on your startup’s unique circumstances, resulting in significant cost savings.

Taking advantage of tax credits can boost your company’s cash flow and improve its financial health.

Secure and Reliable

Partners with top financial institutions, ensuring the safety and security of users’ sensitive financial data.

Utilizes multiple layers of encryption and security protocols, protecting against potential cyber threats.

Regularly undergoes third-party audits and adheres to industry best practices to maintain high security.

Use Cases & Applications

Streamlining the Funding Process: Founders can secure funding faster by providing clear and comprehensive financial reports to potential investors, which showcase the startup’s health and prospects in an easy way.

Planning Your Business Course: Utilize Fondo to strategically plan your business’s financial course, ensuring you’re on track to meet your goals by the specified date.

Simplifying Employee Tax Obligations: Fondo offers a straightforward solution for managing your employees’ tax withholdings and filings, making it easier to stay compliant with federal and state requirements.

Ease of Monitoring Financial Health: Monitor your startup’s financial health, from funding to expenditure, by leveraging Fondo’s real-time bookkeeping and financial reporting. This ensures data-driven and timely decisions.

Who is Fondo For?

Tech Startups: Innovators looking to optimize financial management and stay current with tax obligations.

Seed Stage Companies: Early-stage startups must manage finances efficiently from the average first funding date.

Growth-Focused Businesses: Companies aiming for expansion and needing to streamline tax credits and bookkeeping workflows.

Serial Entrepreneurs: Experienced founders juggling multiple startups, seeking a centralized finance and tax solution.

Pricing & Plans

Starts at $449/month.

What are Users Saying About Fondo?

Anthony Scarpone-Lambert (CEO & Founder, Adni): I highly recommend Fondo! They have saved us a lot of time. They are extremely founder-friendly and very responsive.

Erika Hairston (CEO & Founder, Edlyft): I’ve been a happy user of Fondo and love it! The team is over the moon about ensuring a great user experience.

Scott Sonneborn (CEO & Founder, Tydo): Fondo is incredible. The onboarding experience was seamless—less than 15 minutes. I’m pumped to have everything off our plate. It’s very affordable for the level of service (dedicated Slack channel) and the amount of work they do.

Stephen Grabowski (CEO & Founder, Gordian Software): Great experience so far. We have a complex setup, and they outperformed the two previous solutions we tried. Strongly recommend.

Fondo Alternatives

QuickBooks: QuickBooks is a well-known, robust accounting software that offers comprehensive bookkeeping, tax filing, and financial reporting features suitable for businesses of all sizes.

Xero: It is a cloud-based accounting platform designed for small to medium-sized businesses, offering easy integration with third-party apps and streamlined tax handling.

Wave: Wave is free, user-friendly accounting software ideal for freelancers and small business owners. It focuses on simplicity and essential financial management features.

FreshBooks: Geared towards small business owners and freelancers, FreshBooks offers intuitive invoice creation, expense tracking, and time tracking capabilities alongside tax services.

FAQs

Can Fondo File My Taxes If My Startup Has Revenue in Swedish and Italian Markets?

Yes, Fondo can accommodate filing taxes for operating startups with revenue streams in multiple international markets, including Sweden and Italy. Their team of experts is equipped to handle complex tax situations and ensure compliance with local and international tax regulations.

How Does Fondo Handle Currency Conversion for International Transactions?

Fondo uses real-time exchange rates to convert transactions made in foreign currencies accurately. This ensures that your startup’s financial reporting and tax filings reflect its most current and accurate financial picture, regardless of the currencies involved.

Is Support Available in Languages Other Than English?

Currently, Fondo primarily offers support in English. However, they have a Swedish app and are working on expanding their language offerings.