Do you want to increase your profits in stock trading without spending hours manually analyzing the markets?

Artificial Intelligence (AI) is transforming the world of trading, and in 2023 there will be numerous AI trading software solutions available that can help investors step up their stock market games and make smarter, more profitable investments.

From machine learning algorithms powering automated portfolio management tools to artificial neural networks recognizing patterns from years’ worth of data, these AI trading platforms provide traders with a powerful suite of tools for understanding that human comprehension alone cannot achieve.

This blog post will look at seven top AI Trading Software that promises heightened accuracy and enhanced consistency when making financial decisions.

Table of Contents

What is AI Trading Software?

AI Trading software is an intuitive technology that has been gaining popularity among traders in the stock trading world.

It is an advanced system that uses artificial intelligence algorithms to analyze vast amounts of data and trade stocks to help traders make smart investing decisions.

This software uses machine learning, natural language processing, and deep learning techniques to identify and analyze market trends, patterns, and financial risks.

AI trading software can predict market trends and identify stock trading strategies much faster than humans, which is a huge advantage for traders.

While it’s no more news that investing involves risk, AI trading software supplements traditional stock trading methods. It is beneficial in high-frequency trading, where speed and accuracy are crucial.

AI stock trading software has the potential to influence the financial industry by offering mutual fund investors a competitive edge and boosting returns.

What is the Best AI Trading Software?

AI stock trading bots have become increasingly popular over the years, helping investors make sound financial decisions faster.

Picking the best AI trading software, however, can be quite tricky, especially given the abundance of available options.

The best AI investing software should be able to adapt to the ever-changing market conditions and provide accurate predictions for future performance.

It should also offer advanced features such as backtesting, portfolio management and optimization, and financial risk management tools.

However, it’s always important to remember that while an AI investing app can be incredibly helpful, it’s not a replacement for sound financial advice or due diligence.

We have a compiled list of some of the best AI investment apps you can explore in 2023 to make smart investment decisions:

Trade Ideas

The first AI trading platform on our list is the Trade Ideas stock trading app.

This user-friendly investing app stands out from the rest with its innovative technology that combines machine learning, artificial intelligence, and human insight to identify future investment success.

With its customizable filters and alerts, Trade Ideas AI investment software allows traders to fine-tune their strategies based on individual preferences and risk tolerance.

The software also boasts a user-friendly interface that makes it easy to navigate and use.

In short, Trade Ideas is an excellent choice for any trader looking to stay ahead of the curve in the fast-paced world of the stock market.

Pros

Cons

Price

Trade Ideas has two pricing plans:

- Standard Plan: The price starts at USD 84/month

- Premium Plan: The price starts at USD 167/month

Charles Schwab

Are you looking for an AI investing app that can guarantee future performance? Don’t look further than Charles Schwab.

This top-notch AI trading app is powered by a sophisticated artificial intelligence engine that can accurately predict future investment performance through its ability to analyze complex market data and trends.

The software also comes with various features, such as backtesting, portfolio optimization, and financial risk management tools, making it easy to sell stocks and handle routine financial tasks.

Additionally, Charles Schwab’s customer support team is always available to answer any questions.

Pros

Cons

Price

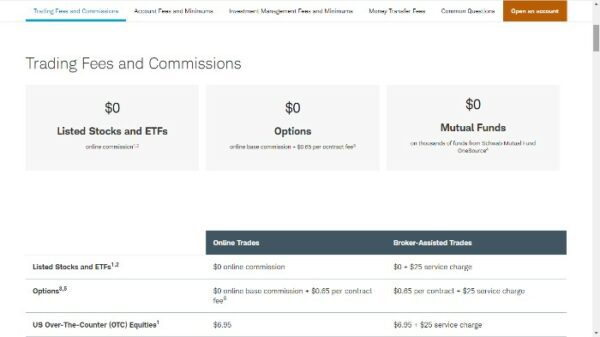

Charles Schwab’s Trading Fees and Commissions:

- Listed Stocks and ETFs: $0

- Options: $0 and a commission of + $0.65 pet contract fee

- Mutual Funds: $0

Acorns

With its sleek user interface and intuitive design, Acorns AI trading app offers a simple yet effective way to build.

This trading platform has professionally managed portfolios for clients with proven historical data.

The software uses artificial intelligence technology to identify and analyze patterns in the stock market that can help you make sound financial decisions.

You can also choose from a wide range of pre-set portfolios based on your risk tolerance or create a custom portfolio based on your individual investing goals.

Unlike many other investing sites, Acorns offers its users free financial advice and insights from a team of experienced advisors who are always available to answer any questions.

Pros

Cons

Price

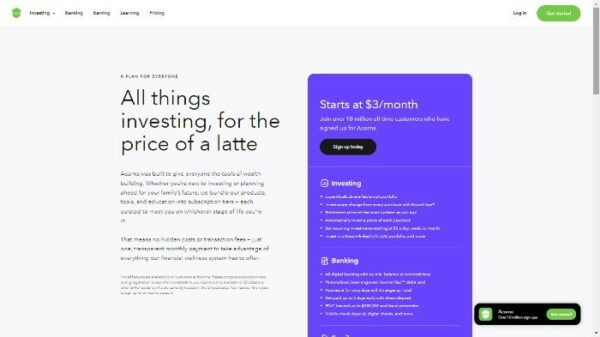

Acorns have a single-paid plan: The price starts at USD 3/month.

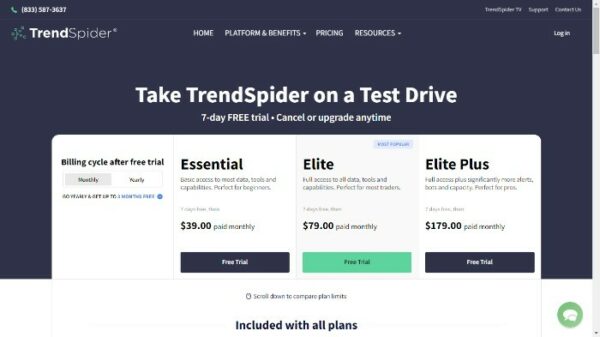

TrendSpider

TrendSpider is one of the best AI trading software available today. It is equipped with advanced algorithms that provide traders with a detailed analysis of the market trends.

The platform offers a range of features to make trading simple and accessible for existing or prospective clients.

The user-friendly interface allows traders to set up custom alerts for trade stocks, backtest their strategies, track investment transactions, and automate their trading.

Furthermore, TrendSpider’s machine-learning capabilities allow it to scan the market and identify potential trading opportunities accurately.

It is undoubtedly an excellent tool for those who seek to enhance their trading performance and improve data points with the help of artificial intelligence.

Pros

Cons

Price

Trendspider has three pricing plans:

- Premium Plan: The price starts at USD 39/month

- Elite Plan: The price starts at USD 79/month

- Elite Plus Plan: The price starts at USD 179/month

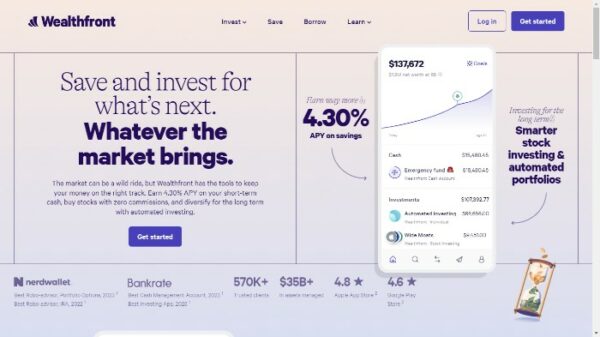

Wealthfront

Wealthfront is a popular automated investment service that uses sophisticated technology to provide investors with portfolio management, advice, and tax-optimized trading strategies.

The company applies artificial intelligence algorithms to improve the accuracy of its decisions and helps users make more innovative investments.

This AI trading app also offers personalized portfolio recommendations for users based on their historical price data and current market conditions. It makes it a clear AI trading software overall idle investment money sitting platforms.

Unlike other AI investing apps, the Wealthfront platform is carefully designed to make it easy for users to understand the investment process and keep track of all the investments in one place.

Pros

Cons

Price

Wealthfront does not provide the pricing details on its homepage.

Tickeron

The Tickeron platform is a powerful AI trading software that allows traders to access all the information they need in one place.

It offers real-time market data, including price trends and news articles related to the stock markets, as well as technical and fundamental analysis tools to help users improve their investment portfolios.

The app also provides users with AI-driven portfolios to help them track their investments and make profitable trades.

The Tickeron Artificial Intelligence system scans millions of data points from news sources, stock markets, technical analyses, and other relevant sources to accurately predict the direction in which a stock’s price is likely to move in.

Pros

Cons

Price

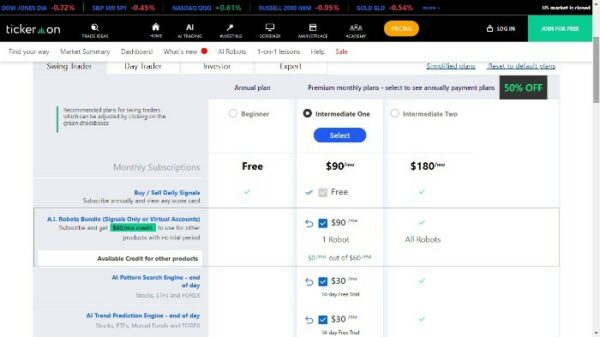

Tickeron has three pricing plans:

- Beginner Plan: It is free

- Intermediate One: The price starts at USD 90/month

- Intermediate Two: The price starts at USD 180/month

Betterment

Improving your past performance has never been easier with Betterment, an automated investment service that applies cutting-edge AI algorithms to provide users with tailored advice on their portfolios.

This app uses its sophisticated technology to analyze past data and identify patterns in financial trends, enabling users to make informed decisions for a better investment return.

Betterment provides insights into each stock, including its historical performance, expected returns, and other key indicators.

Pros

Cons

Price

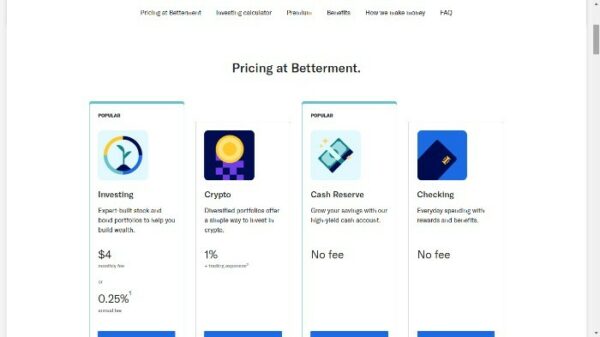

Betterment has different pricing for different activities:

- Investing: The price starts at USD 4/month.

- Crypto: Betterment charges %1

- Checking: No fee

- Cash Reserve: No fee

Is VectorVest an AI Stock Trading Bot?

Yes. VectorVest is an AI stock trading software that offers a comprehensive range of features, including real-time market data, forecasting tools, and portfolio optimization.

The company also provides users with automated algorithmic trading strategies to help them make more profitable trades.

Unlike other news and investing sites, VectorVest ensures that the information is accurate and up-to-date by using its proprietary AI technology.

Can I Use AI for Trading?

Yes. Many investors and traders use AI trading software to make informed investment decisions.

AI algorithms can improve your portfolio performance, provide real-time market data and insight into stock trends, and generate automated trades based on the information provided.

AI trading software also allows users to customize their portfolios better to reflect their risk tolerance and desired returns.

Conclusion

AI trading software is an excellent tool for traders and investors to use to make better investment decisions and improve trading stocks.

The apps mentioned above provide users with AI-driven portfolio management, real-time market data, forecasting tools, and automated strategies that can help them generate profits.

By taking advantage of the features offered by this AI trading software, traders and investors can make more innovative investments that will help them save time and money.

In addition to these apps, there are also other AI stock trading services available on the market that offer similar features.

It is essential to research before investing in any of these services, as each has advantages and disadvantages.

On a final notice, AI trading platforms are significant financial assets for traders and investors to make smarter decisions about their investments and maximize their return on investment.