Are you a startup looking for ways to fund your budding business? If so, you’re in the right place. In this CapChase review 2023, we’ll discuss upfront cash flow and how it can benefit your enterprise.

This non-dilutive financing platform has a team of finance professionals that evaluate founders’ accounts receivables and design custom payment-based funding solutions tailored to each financial situation.

With their help, startups can access much-needed funds without waiting for clients’ payments or selling equity shares.

We’ll dive into details about how the platform works and explore stories from real startups that used upfront cash flow to get an influx of reliable capital – turning their respective dreams into reality!

Table of Contents

What is CapChase?

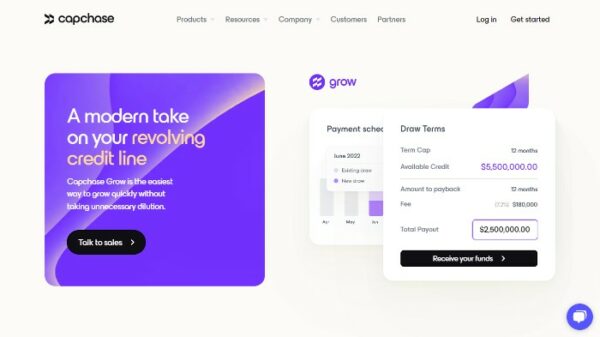

CapChase is a financing platform that helps businesses unlock their recurring revenue instantly. This innovative finance partner for SaaS provides a more efficient way for startups to receive funding by leveraging their future revenue.

Their goal is to empower businesses with the resources needed to grow and succeed without the burden of debt.

With this alternative financing platform, companies can access the cash flow they need to invest in their operations without sacrificing equity or dealing with high-interest rates.

They are committed to providing a seamless funding experience that enables businesses to focus on growth – building their business without stressing their working capital.

Who Created CapChase?

CapChase was co-founded by Miguel Fernandez Larrea (Co-Founder & CEO), Ignacio Moreno Pubul, and Luis Basagoiti Marques (Co-Founders).

Miguel is a serial entrepreneur with a background in venture capital, technology, and finance. Ignacio and Luis have extensive experience in international business development and financial services.

The three founders combined their expertise to create an innovative financing platform to help businesses access the cash flow without sacrificing equity or incurring debt.

Top Benefits of Using CapChase

1. Get access to instant cash flow: CapChase provides businesses with an efficient way to unlock their future revenue and get the working capital they need without taking on debt or sacrificing equity.

2. Customized financing solutions: The team designs a personalized strategy tailored to each client’s financial situation and needs so businesses can enjoy a higher valuation.

3. Easy and secure process: The team uses a streamlined and secure process to ensure businesses access the funds they need quickly and safely, eliminating the hassle associated with traditional financing methods.

Best Features of CapChase

CapChase offers numerous features to help you raise funds for your investments and improve your company’s growth.

This platform allows businesses to receive the cash they need upfront without waiting for the cash flow to arrive.

It has easy-to-read dashboards and automatic invoicing and can connect to more than 5,000 financial institutions.

Let’s look at some of the best features to explore when you sign up for the platform

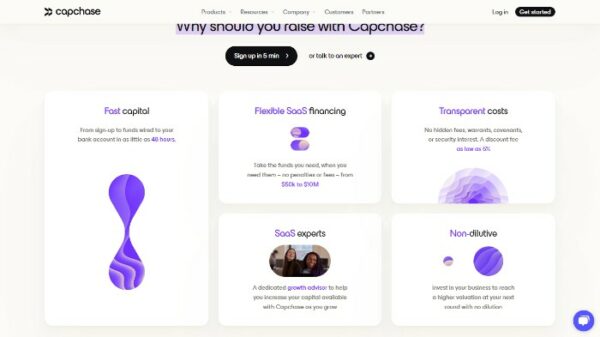

Non-Dilutive Capital

CapChase is a powerful platform to help startups access the capital they need to grow and thrive.

One of the platform’s best features is the access to non-dilutive capital they need to take their operations to the next level quickly.

This is ideal for startups and other businesses looking to maintain control of their company while still accessing capital.

With its flexible payment plans and low-interest rates, companies can repay their loans without worrying about massive credits.

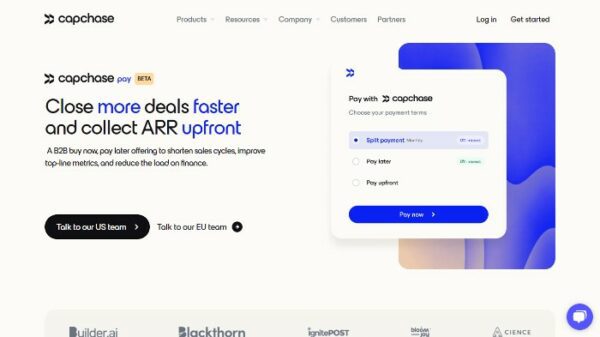

Beta Pay

This feature allows businesses to pay their suppliers quickly and securely. It is an easy-to-use platform with automated invoicing and payments, helping companies stay organized and get the most out of their working capital.

This payment method offers flexibility, transparency, and improved cash flow management while collecting your ARR upfront.

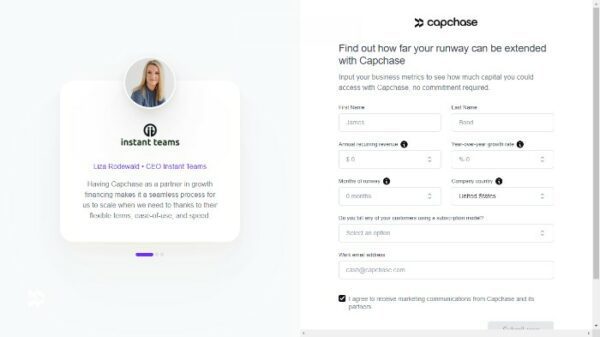

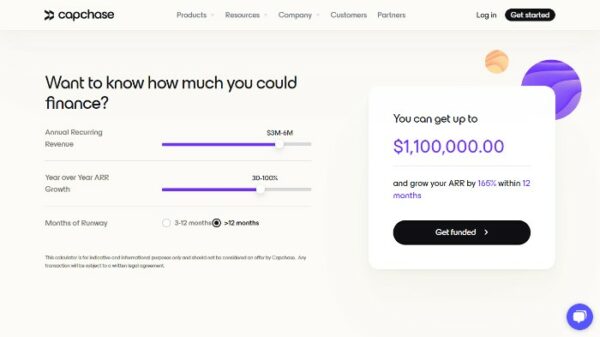

Runway Calculator

This feature helps companies understand their revenue and spending to plan for the future.

The calculator gives companies an accurate estimate of how much capital they need to cover their expenses until the next milestone, giving them more control over their cash flow.

The Runway Calculator also explains how different financing methods affect a company’s financials and recommends optimizing its bling capital to increase key business metrics.

With its innovative features, companies can unlock their future revenue and get the funding they need quickly and safely.

SaaS Experts

The team at CapChase are experienced SaaS experts who understand SaaS companies and help them monitor their sales cycle and make the most of their cash flow.

They understand the unique needs of startups and other businesses, which makes them an excellent choice for those looking for more personalized financing solutions.

Their team is knowledgeable, reliable, and dedicated to providing clients with the best advice and resources to improve their company growth.

The team is also available around-the-clock, providing support and guidance whenever needed.

CapChase Pricing: How Much Does it Cost?

The platform has not provided any information about its pricing plans.

However, they offer transparent costs without hidden fees, warrants, covenants, or security interests.

They also offer a discount fee of as low as %5. Contact their admin to learn more about their custom pricing plans.

CapChase’s Pros and Cons

In today’s ever-evolving business world, companies constantly look for innovative ways to finance their operations.

One such funding solution that has gained popularity in recent years is revenue-based financing, where CapChase comes into play.

While the initiatives offer some significant benefits, such as increased flexibility and less ownership dilution, it also has potential drawbacks that cannot be ignored.

As savvy business owners, it is essential that we explore both the pros and cons of this platform to make informed decisions and ultimately achieve long-term success.

Join me in delving into the nuances of revenue-based financing and discovering why it is worth our time and consideration.

Pros

Cons

Alternatives for CapChase

While CapChase is an ideal profitability platform for non-dilutive financing, it may not be suitable for some users.

If you’re in this category, you need not worry, as several alternatives offer the primary set of features to the platform.

Here are some of the best alternatives for CapChase:

- Brex

- Pipe

- Uncapped

- Clearco

- BlueVine

- Float

- Yoii

- Clearbanc

- Founderpath

- Fundbox

These options provide similar services and features to CapChase with slightly different terms and conditions. It’s best to compare these platforms side by side before deciding.

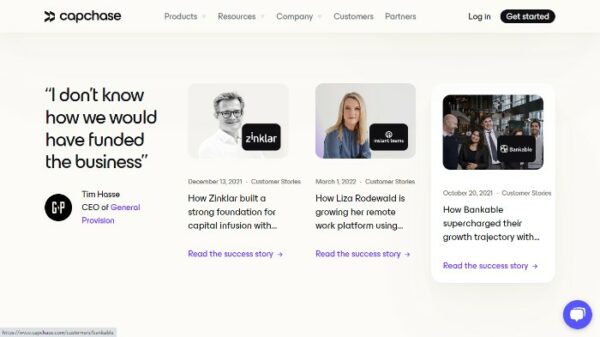

CapChase’s Case Studies: Results Achieved with the Platform

CapChase has provided some case studies of businesses that have achieved success with their platform.

For example, they helped a SaaS company increase its operating capital by using its Runway Calculator to understand and optimize its cash flows. This allowed the company to raise more money at better terms and access a larger pool of resources.

Another example is an eCommerce company whose revenues were hit by the pandemic. Through their platform, they raised funds for digital marketing campaigns, allowing them to recover and maintain good financials.

These case studies show that CapChase is a reliable solution for businesses looking for fast, flexible funding solutions without sacrificing ownership or long-term success.

My Experience Using CapChase

I recently used CapChase to finance my business operations and was quite pleased with the results.

The whole process was smooth and easy, with no hiccups. The platform provided clear guidance on all stages of the funding process, making it an ideal choice for those unfamiliar with revenue-based financing.

Moreover, the repayment terms were highly flexible and gave me enough breathing space to make my business grow.

Most importantly, I could access capital without giving up any equity or ownership in my company.

This platform is ideal platform for those looking for quick financing and a hassle-free experience.

Highly recommended!

What are the Minimum Requirements for CapChase?

CapChase requires companies to have $100,000 in ARR & 3 Months of Runway required and be a corporation or limited liability company.

Additionally, prospective users must meet a minimum credit score requirement and provide financial documents such as income statements and balance sheets for verification.

These requirements are relatively easy to meet but will vary depending on the applicant’s financial background.

Conclusion: Is CapChase Worth it?

The ability to access financing with CapChase is a game-changer for startups. By leveraging unique strategies like unit economics and caffeinated capital, CapChase is opening one of the most efficient paths for companies to secure funding.

Additionally, by partnering with QED Investors, a premier VC funding, CapChase helps founders drive even more success through their startup journey.

For these reasons, it’s clear that the services offered by this platform should be seriously considered for startups looking for an alternate form of funding.

Make your dreams a reality today with CapChase – a finance partner for SaaS platforms that wants to see your business reach its potential!